Last week, Thomas presented a $160,009,845, which “pays for services, invests in productivity, revenue generation and infrastructure,” while staying under the state’s mandated tax cap of 2.7 percent. It is an increase of approximately 4 percent from the 2018 adopted budget ($111,247,888) and would include the appointment of 18 new staff positions within the city.

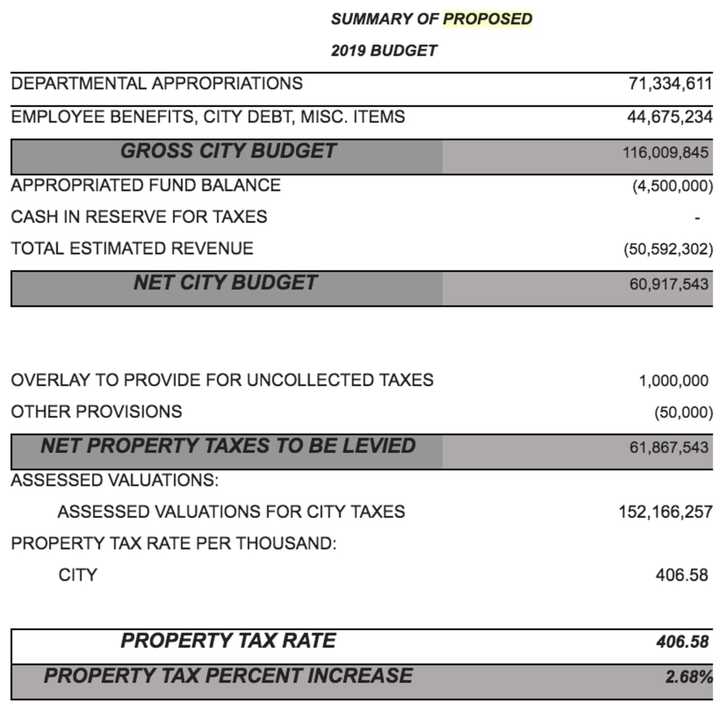

Thomas noted that the tax increase would work out to approximately 25 cents a day for the average homeowner in Mount Vernon. The proposed tax increase is 2.68 percent, with a tax rate per $1,000 of assessed valuation is $406.58.

“Every budget comes down to making choices,” he said. “There’s never enough money, so the ‘must haves’ need to be separated from the ‘nice to haves.’ Our 2019 proposed budget delivers essential services, invests int he future of our great city and does so with an affordable tax increase of about 25 cents a day.”

According to Thomas, “spending is offset by revenues of 9 percent. This is a conservative forecast, considering the strength of the Mount Vernon economy as evidenced by the 10.6 percent increase in sales tax revenues in the first half of 2018.”

“When taken together, city, county and school taxes place a high burden on our taxpayers,” Thomas added. “This is especially true this year with the uncertainty created by the limits on state and local deductions in the new federal tax code. As a result, we are doing everything we can to keep property taxes as low as possible.”

The full proposed budget can be found here.

Click here to follow Daily Voice Pelham and receive free news updates.